Prøve GULL - Gratis

Money Grows on Trees, Slowly

Forbes India

|November 14, 2025

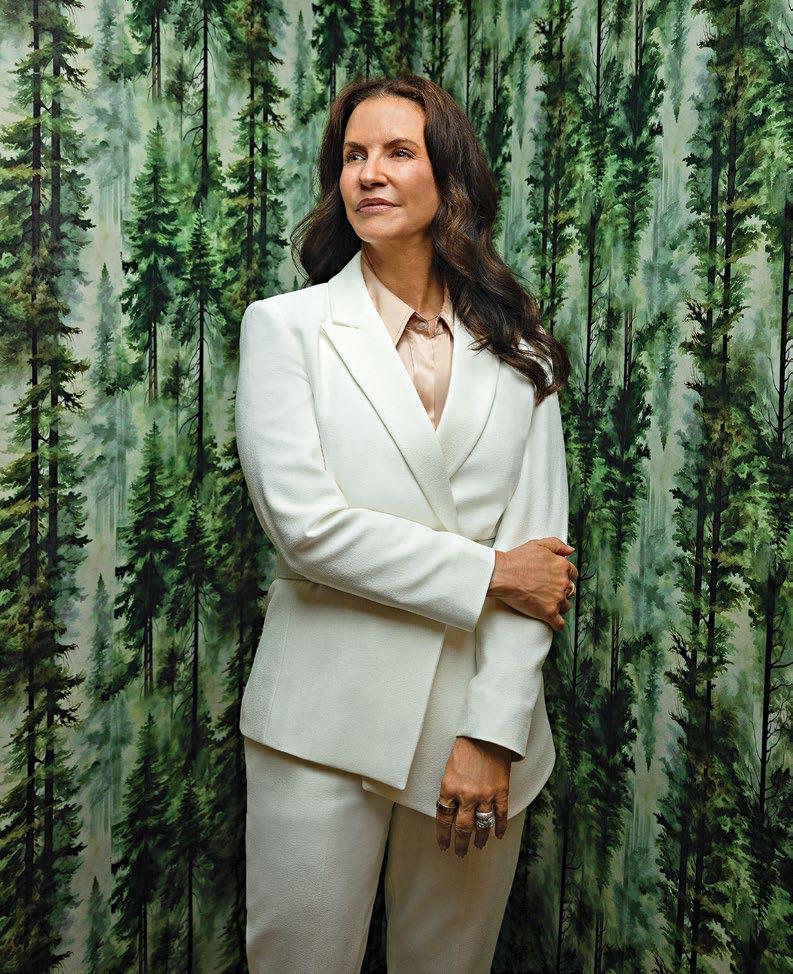

If you are a very patient investor, you might want to have Angela Davis's Campbell Global plant you some Douglas fir

Invest capital and save the planet at the same time.

Own a forest. That's the selling proposition from Angela Davis, who, as president of Campbell Global in Portland, Oregon, oversees $10 billion on behalf of institutions and wealthy individuals. So far she has acquired 1.4 million acres of trees, the majority in the US, with some in Australia and New Zealand.

Do not expect from timberland the kind of action you'd get from a semiconductor stock. “Forest investors are typically not looking for high risk and high return,” Davis says. What are they looking for? Four other things: A yield, an inflation hedge, a portfolio-stabilising lack of correlation to the stock market and the environmental virtue that comes from taking carbon out of the air.

The yield comes naturally. Trees grow. Douglas fir, the money tree in the Pacific Northwest, is harvested at 45 years of age. A timberland property that contains tracts evenly distributed over the age spectrum will have an average age of 22. This means the wood that can be taken annually from mature trees comes to 4.4 percent of the total volume of wood in the forest.

That 4.4 percent botanic payout is the starting point for expected return. Log prices, sensitive to homebuilding demands, are extremely volatile, but over the long pull they, and the residual value of cleared land, should keep up with inflation. Add in inflation and a 7 percent nominal return is within reach.

Denne historien er fra November 14, 2025-utgaven av Forbes India.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

Listen

Translate

Change font size