Essayer OR - Gratuit

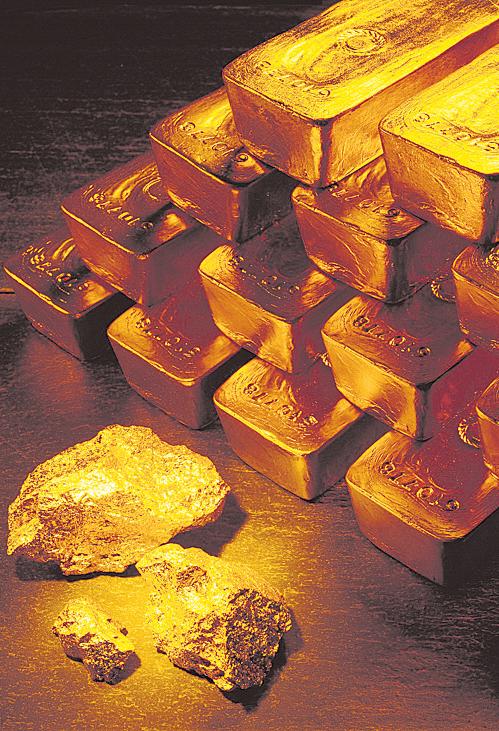

Investors tempted to buy gold shouldn't expect glittery gains

Mint Bangalore

|October 29, 2025

Gold is not as safe an investment at this juncture as it might seem

When I can’t listen to a podcast without someone trying to sell me gold, when money managers tell me clients are 'jonesing' for the shiny metal and when friends call to ask what I think about buying it, I know without looking at a single chart that the price of gold has gone vertical and that FOMO has set in.

And wouldn't you know, the price of gold skyrocketed this year in one of the biggest rallies since its price began to float freely in 1968. Google searches for 'how to buy gold' are at a record high. Net flows to US-based gold mutual funds and exchange-traded funds topped $35 billion this year through September, according to Morningstar, the largest nine-month haul since at least 2005.

This begs the question: Should investors own gold? I have no doubt that Wall Street, which never misses an opportunity to peddle a hot asset, suddenly thinks so. Morgan Stanley's Mike Wilson has suggested that investors in a traditional 60:40 stock: bond portfolio move half the bond allocation to gold, rejigging their portfolio into a 60:20:20 ratio for stocks: bonds: gold.

At first glance, this looks like an upgrade. The gold-infused portfolio would have beaten a 60: 40 comprised of the S&P 500 Index and a basket of US government and corporate bonds by 0.7 percentage points a year from April 1968 through September, including dividends.

Cette histoire est tirée de l'édition October 29, 2025 de Mint Bangalore.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Bangalore

Mint Bangalore

An old pain returns to cloud Tata Power earnings outlook

An old issue at the Mundra thermal plant has resurfaced for Tata Power Co. Ltd to further cloud its earnings prospects.

1 mins

November 14, 2025

Mint Bangalore

AI’s next smart move might be scrapping the chatbot entirely

Conversational AI introduces too much risk and unpredictability

3 mins

November 14, 2025

Mint Bangalore

LG Electronics India Q2 profit falls 27%

LG Electronics India on Thursday reported a 27% fall in quarterly profit in its first results since listing, as consumers delayed purchases of electronics and home goods following recent tax cuts.

1 min

November 14, 2025

Mint Bangalore

The income survey won't answer the questions around inequality

The survey is welcome but the absence of past data means we won't know if inequality has reduced

3 mins

November 14, 2025

Mint Bangalore

Brokers struggle to meet Sebi deadline on retail algo trading

Stockbrokers are scrambling to meet a series of cascading regulatory deadlines to implement new algorithmic trading rules for retail investors, a landmark shift that promises to democratize sophisticated trading tools but has triggered technical and compliance hurdles.

2 mins

November 14, 2025

Mint Bangalore

SC reserves verdict on telco spectrum

The SC examines if licensed spectrum belongs to operators or government.

1 min

November 14, 2025

Mint Bangalore

Xi Jinping to skip G20 in South Africa

Chinese President Xi Jinping will not join the Group of 20 summit later this month, a move that will be a blow to host South Africa that's already facing a boycott from US President Donald Trump.

1 min

November 14, 2025

Mint Bangalore

Govt pulls QCOs on 14 polyester inputs

and integrated backwards. We welcome the decision of the government, and we will continue to stay competitive offering the best quality products to the downstream industry for domestic and value-added export market.”

2 mins

November 14, 2025

Mint Bangalore

Inside the pub behind 1,000 love stories

A 165-year-old tavern in Philadelphia is the US city's unlikeliest match-maker, proving in-person connections hold more power than dating apps

3 mins

November 14, 2025

Mint Bangalore

Tata Steel remains wary about its UK ops

Tata Steel Ltd ramped up India output and cut costs during the July-September period, lifting its financial performance, but its UK unit remains a drag amid cheap imports despite an expensive restructuring, top company officials said.

2 mins

November 14, 2025

Listen

Translate

Change font size