Intentar ORO - Gratis

Gold Surges 30% in 2025: Should You Invest Or Wait For A Correction?

Outlook Money

|July 2025

With gold prices soaring and uncertainty dominating headlines, many investors are asking if this is the right time to take the plunge or sit tight

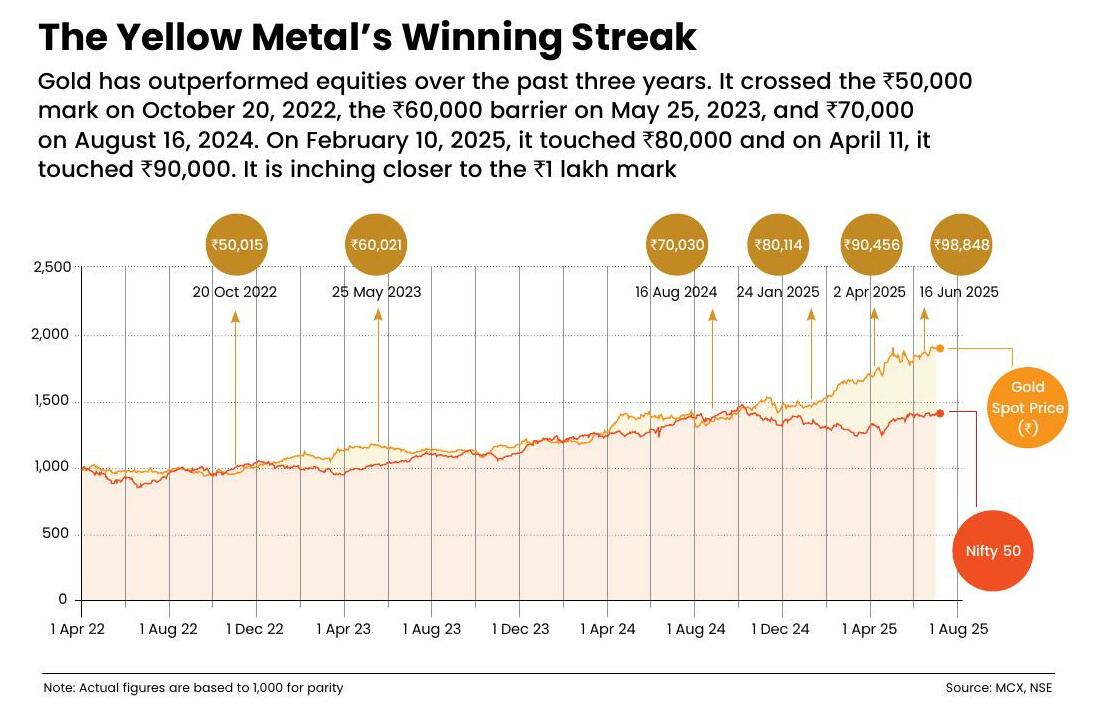

Gold prices are on a record-breaking spree, rewriting history with every surge. Since February 2024, gold prices have been on a spectacular rally, and since the beginning of 2025, they have risen by over 30 per cent. They have also beaten equity returns over the past three years.

On January 24, 2025, the spot gold price on Multi Commodity Exchange (MCX) surpassed the psychological level of ₹80,000 per 10 gram for the first time, and by the end of March, it breached the ₹90,000 mark, clocking a gain of a little over 7 per cent in March alone. Now it is on the verge of surpassing ₹1 lakh. As on June 20, it closed at ₹98,071.

This robust performance was consistent across major currencies. Spot gold price in the international market crossed the psychological level of $3,000 per ounce on March 18, 2025, and by the beginning of May, it reached $3,392 per ounce, hovering near $3,368 per ounce as on June 20.

In the race for returns, gold has outpaced the widely-tracked indices Nifty and S&P Sensex by a significant margin in the last three years. The yellow metal has yielded 30.40 per cent returns year-to-date (YTD) as on June 20, 2025, compared to 6.21 per cent returns by India's benchmark indices Nifty.

What Is Pushing Gold Prices?

The factors that contribute to the rise in gold prices are many. Unlike other commodities, whose prices are primarily driven by demand and supply, the price of gold is influenced by a range of additional factors, such as economic downturns, interest rate trends, and geopolitical tensions. A new factor now impacting gold prices is tariffs.

Ongoing Geopolitical Tension:

After four consecutive months of positive returns, gold experienced a slowdown in May 2025, though it remained relatively flat from the April closing figure.

Esta historia es de la edición July 2025 de Outlook Money.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Outlook Money

Outlook Money

Is Silver The New Gold?

Silver, an asset once considered gold's quieter cousin is now commanding investor's attention, given its extraordinary rally this year, with prices soaring to multi-year highs and shattering previous records. But does it make sense to add a touch of silver shine to your portfolio now?

7 mins

November 2025

Outlook Money

NPS MSF Schemes: More Choice Or More Confusion?

The launch of shorter-term schemes under the Multiple Scheme Framework (MSF) of the National Pension System (NPS) has given more choice to investors, but will that breed confusion and are these schemes fit for consistent long-term savings?

5 mins

November 2025

Outlook Money

Is Silver The New Gold?

Silver, an asset once considered gold's quieter cousin is now commanding investor's attention, given its extraordinary rally this year, with prices soaring to multi-year highs and shattering previous records. But does it make sense to add a touch of silver shine to your portfolio now?

7 mins

November 2025

Outlook Money

Invest with the Rhythm of the Market

Let professionals rotate sectors as cycles turn while you stay invested steadily.

2 mins

November 2025

Outlook Money

Stop Worshipping Sips And Start Using Them For Goals Now

Set an amount, automate increases, ignore noise, stick to horizons, review annually.

2 mins

November 2025

Outlook Money

Build Wealth That Survives Cycles With Ruthless Asset Allocation Discipline

Hold equity, debt and gold in balance and rebalance when valuations stretch.

3 mins

November 2025

Outlook Money

Gold As An Investment Not Ornament

Festive buying meets modern investing as the panel explains gold ETFs, costs, risks and mindset needed to make gold work.

1 mins

November 2025

Outlook Money

How To Handle A Cashless Health Claim

With many hospitals suspending cashless health insurance option, here's how to manage your temporary cash requirement and claim for a reimbursement from your insurer later

5 mins

November 2025

Outlook Money

Invest In Gold And Silver MFs And ETFs For Tax Efficiency

I recently retired with a Provident Fund of ₹70 lakh and equity and mutual fund investments of around ₹60 lakh. I plan to sell my house for ₹60 lakh and buy a smaller apartment for ₹30 lakh.

2 mins

November 2025

Outlook Money

'We Want That Even Before You Buy A Mutual Fund, You Should Be In NPS'

Pension Fund Regulatory and Development Authority (PFRDA) chairperson S. Ramann, in an interview with Outlook Money Editor Nidhi Sinha as part of the Wealth Wizards series, talks about how the National Pension System (NPS) is moving from catering to the government sector to the non-government sector, why the regulator is focusing on larger distribution through new Multiple Scheme Framework (MSF) products, why it's important to have more choice in pension products and how NPS is turning into an end-to-end product.

8 mins

November 2025

Listen

Translate

Change font size